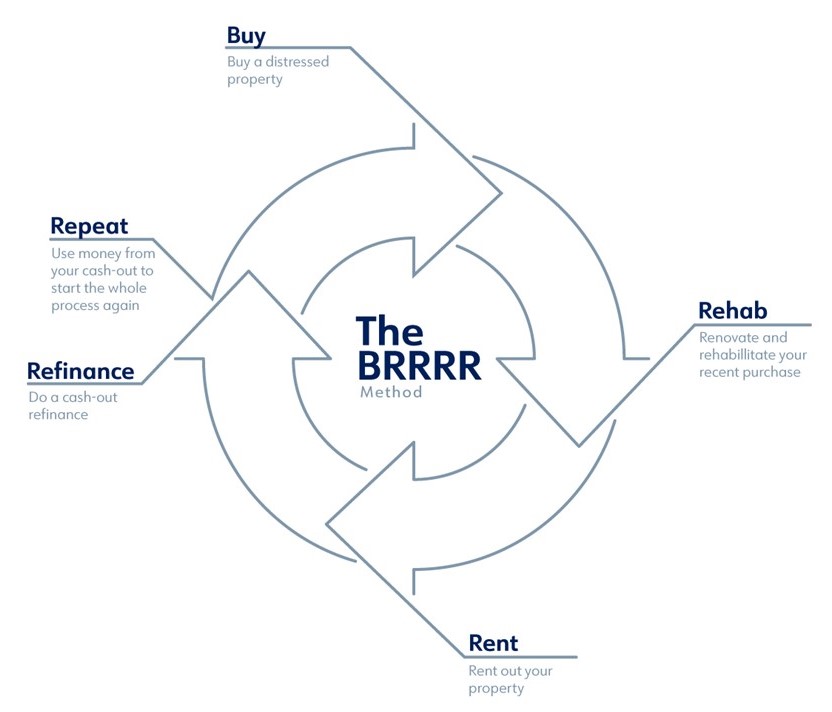

BRRRR strategy can provide passive income and a revolving method for purchasing and owning rental property. The method works through the following steps: Buy a property: The property you purchase should be a distressed property that needs some work to get […]

read more

Investor Loans

Understanding BRRRR for Real Estate Investing

5 Things You Should Know Before Investing in a Turnkey Property

What is Turnkey Investing? At its core, turnkey real estate investing is where you buy already rehabbed, tenant-filled, managed properties that are producing positive cash flow. A lot of the extra work that goes into real estate investing is cut […]

read more

read more

Fannie Mae Reserve Requirements for Investors with Multiple Properties Owned

What Are Reserves? Reserves are liquid or near liquid assets that are available to a borrower after the mortgage closes. On every loan transaction, reserves are required to be verified as part of the approval process. Acceptable sources or reserves […]

read more

read more

Seven Secrets To Successful Single-Family Rental Real Estate Investing

Real estate investing in general, and single-family real estate investing in particular, is very different from buying stocks, commodities or most other investments. Real estate is a leveraged investment that has the potential for delivering excellent returns because the cash […]

read more

read more

Thing You Need to Know About a 1031 Tax Exchange

The identification period in an IRC Section 1031 delayed exchange begins on the date the taxpayer transfers the relinquished property and ends at midnight on the 45th calendar day thereafter. To qualify for a 1031 tax-deferred exchange, the tax code […]

read more

read more

Dallas Makes Rules Tougher on Landlords with New Housing Standards

Dallas leaders say renters will be less susceptible to slumlords after the City Council voted Wednesday to overhaul the city’s housing standards and require code inspections of single-family rental homes for the first time. The new minimum housing standards also […]

read more

read more

How Many Loans Will the Fannie Mae and Freddie Mac Lend to Investors?

In 2009, Fannie Mae and Freddie Mac rolled back the mortgage rule that prevented real estate investors from financing more than 4 properties per borrower. At the time, investors were limited to 4 properties financed, which included their primary residence. […]

read more

read more